Our

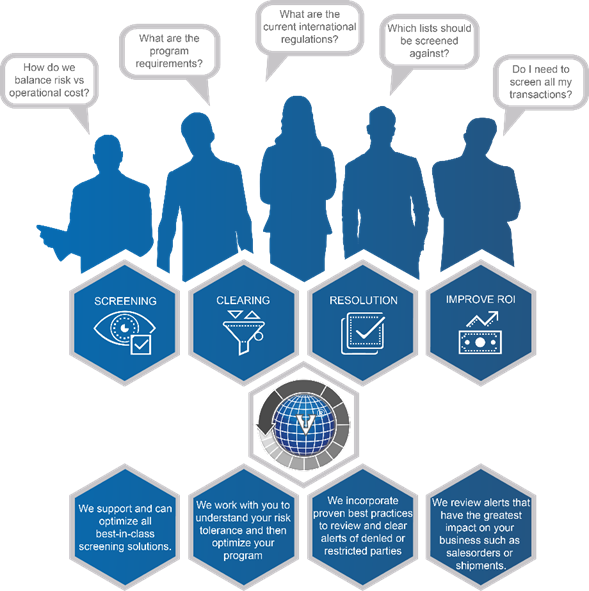

Screening, Clearing & Resolution Services

Managing Compliance In A Rapidly Changing Regulatory Environment

Vigilant’s screening, clearing, and resolving service combines experienced analysts with our proven Tiered Review Methodology to cost-effectively screen your transactions, vendors, clients, prospects, and employees. We can partner with you to optimize your program to screen against the correct lists and have an appropriate level of potential matches to clear.

All our services

Worldwide Import & Export Classification

Screening, Clearing & Resolution

Logistics Support & Management Services

Help Desk Support

Technology-As-A-Service

GTM Software Enablement

Trade Compliance Optimization

Client Specific Solution Design

Prior to commencing any screening-related work, Vigilant confirms your risk tolerance, approved policies, processes, and specific program requirements. In the absence of defined processes and procedures, we can share best practices and our experience to help you optimize your program. We are software agnostic, so we can leverage your screening solution or recommend a solution from one of our partners. We will design a service to meet your required hours of coverage.

Intelligent Tiered Review Methodology

Vigilant intelligently prioritizes and reviews potential matches (“blocks or hits”) that can have the greatest impact on your business, such as sales orders or shipments. Our Tiered Review Methodology was designed to minimize disruptions to your organization while effectively mitigating risk.

Secure, GDPR Compliant, Scalable & Global Support

Vigilant’s flexible staffing model includes remote teams, as well as European (GDPR Compliant) and Asian teams working from our secure offices, so you can rest assured that your data will remain private and secure. Moreover, as your volumes unexpectedly increase, we can readily scale to meet your deadlines.

Vigilant’s screening, clearing, and resolution solution will minimize disruptions to your operations, mitigate risk, provide an added measure of security while improving the return on the investment on your screening program.

Our

Screening, Clearing & Resolution Services

Learn about

Managed Services Programs

Managed Services Programs have become a vital component of strategic compliance programs as companies are forced to reduce staffing budgets, pay more for compliance expertise, and limit technology spending while keeping up with the pace of their business objectives and compliance requirements. Vigilant offers client-specific programs, so that you can design a program with as few as one support service or as many as needed to keep you compliant.

Learn about your

Compliance Assessment

We offer a compliance baseline report designed to help you identify potential gaps, risks, or areas for improvement within your global trade compliance program. It doesn't matter if you are new to global trade compliance or a seasoned professional, the assessment is easy to answer and requires only five minutes to complete. Once you have completed the survey, you will receive a summary report and scorecard.