USMCA: Are You Prepared?

USMCA: Are You Prepared?

Where are we?

We are all aware of the impending change from NAFTA to USMCA, but where does it stand today? As of today, both Mexico and the United States have signed the agreement, but it is pending approval of the Canadian Parliament. In October 2019, the Canadian Liberal Party lost its majority representation making ratification more difficult as they now must work across parties for approval. They are hoping to have it entirely ratified by the end of April 2020. Once Canada ratifies, it will take 90 days for the agreement to come into force.

What has changed?

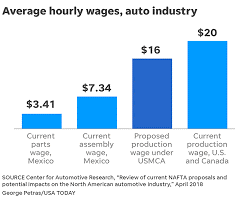

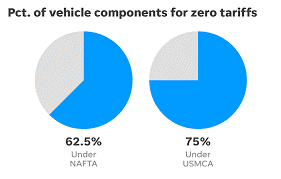

You are probably aware of the recent changes to the automotive industry rules with the regional value content changing from 62.5% to 75% and, 40% of goods manufactured must be produced by workers that earn at least $16 per hour by 2023. What many people are not aware of is that several rules have changed the way goods are qualified. For example, the US will have greater access to the Canadian Dairy industry due to the removal of high duty rates that currently exist under NAFTA.

Although CBP NAFTA Form 434 expired years ago, Customs and Border Protection extended its use; however, under the USMCA, it is no longer valid. Origin Procedure 5.3 states that the certificate of origin need not follow a prescribed format and can even be included on the commercial invoice as long as the Minimum Data Elements under Annex 5-A are detailed. The USMCA also allows for digital transmission of documents, removing the requirement under NAFTA for an original signature in blue ink.

Under USMCA, the NAFTA country of origin rules no longer exist. Historically, an article could qualify under NAFTA and would be “made in” the qualifying country if it met the rule. This does not hold with USMCA as it reverts to traditional country of origin rules for which it may not qualify.

If you have not yet noticed, you should be aware that the rule sets have changed. A good example is the rule for textiles under Chapter 63; Note 1 exists under both agreements, but they have added Note 2, which references goods from Chapter 59 that have to be formed and finished in a USMCA territory. Another example are switches under 8536.50, which are using designations “aa”, “bb” for digits 7 and 8 rather than changing each rule. These are just two of many examples that are changing the way USMCA goods will be qualified.

Are You Prepared?

To avoid disruptions to your supply chain, it is imperative to review your current data to determine if the rules have changed for your products. If the rules have changed, then you need to rerun the determination process as well as solicit updated certificates from your vendors before you run the determination.

At present, we do not know what the effective date of USMCA will be or the additional work required for the remaining calendar year. If you need help managing your determination, solicitation, and certificate management for USMCA, Vigilant Global Trade Services can help. Learn more.